The fastest way to your maximum refund.

File your taxes quickly with help from real people.

Get your maximum refund in 3 easy steps!

First, calculate refund

Answer simple, plain-English questions, and our software will handle all the calculations. We guide you step-by-step, searching over 350 tax credits and deductions to find every dollar you deserve and guarantee your maximum refund.

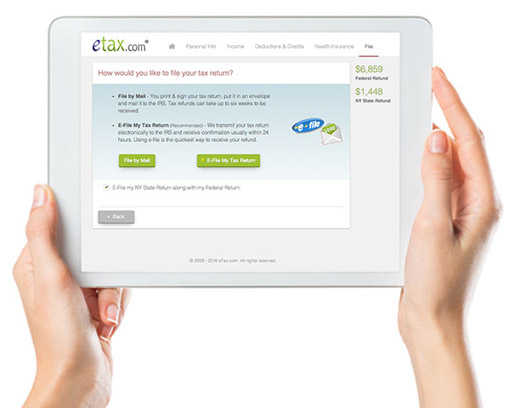

Next, file tax return

Securely e-file your completed federal and state tax returns with 100% accuracy. We run thousands of error checks before transmitting your return directly to the IRS and state, getting you confirmation in as little as 24 hours.

Finally, receive tax refund

Get your money in the fastest way possible. E-filing and selecting direct deposit is the quickest way to get your refund—far faster than by mail. You can track your refund status with us and on the IRS website.

Free live customer support

Get free customer support with real people 7 days a week all based in the United States. If you have questions while filing your tax return with eTax.com, call us at (718) ASK-ETAX.

Get Started Today!

Filing your taxes is simple & quick!

-

A Smart, Guided Interview — Our step-by-step process only asks questions that apply to your unique tax situation. No confusing forms, just simple answers that get your taxes done fast.

-

No Tax Jargon, Guaranteed — You don't need to be a tax expert. We translate confusing IRS language into plain English you can understand, so you can file with 100% confidence.

-

Your Maximum Refund, Every Time — We guarantee you'll get the biggest refund possible. Our software searches hundreds of federal and state tax credits and deductions to find every dollar you deserve.

Security you can trust

-

Bank-Level Data Encryption — We protect your sensitive personal and financial information using 256-bit SSL encryption—the same security standard trusted by major banks.

-

Authorized IRS e-file Provider — As an official IRS E-File Provider, our platform meets and exceeds the rigorous security and privacy standards set by the IRS.

-

Proactive 24/7 Monitoring — Our systems are monitored around the clock and undergo frequent, independent third-party audits to ensure your data is always safe from unauthorized access.